The Single Strategy To Use For Transaction Advisory Services

Wiki Article

The 2-Minute Rule for Transaction Advisory Services

Table of Contents10 Simple Techniques For Transaction Advisory ServicesThe 7-Minute Rule for Transaction Advisory ServicesTransaction Advisory Services Fundamentals ExplainedThe 20-Second Trick For Transaction Advisory ServicesThe smart Trick of Transaction Advisory Services That Nobody is Discussing

This action sees to it the company looks its finest to prospective customers. Getting the company's value right is important for an effective sale. Advisors utilize various techniques, like affordable capital (DCF) analysis, comparing to similar companies, and current purchases, to find out the reasonable market price. This assists establish a reasonable cost and work out successfully with future buyers.Transaction advisors action in to assist by getting all the required information organized, responding to questions from customers, and arranging visits to the business's area. Transaction advisors utilize their know-how to assist business proprietors deal with tough arrangements, fulfill customer assumptions, and framework offers that match the owner's objectives.

Satisfying legal policies is vital in any organization sale. Deal advisory services collaborate with legal specialists to produce and review contracts, arrangements, and other lawful papers. This lowers risks and sees to it the sale follows the legislation. The role of deal experts prolongs past the sale. They assist service proprietors in preparing for their following steps, whether it's retirement, beginning a brand-new venture, or handling their newly found wide range.

Purchase advisors bring a wealth of experience and expertise, making sure that every aspect of the sale is managed properly. With critical prep work, appraisal, and negotiation, TAS assists entrepreneur accomplish the highest feasible price. By guaranteeing lawful and regulatory conformity and handling due persistance along with other offer staff member, purchase experts decrease prospective threats and obligations.

What Does Transaction Advisory Services Do?

By comparison, Big 4 TS groups: Service (e.g., when a possible buyer is carrying out due persistance, or when a deal is shutting and the purchaser needs to incorporate the company and re-value the vendor's Equilibrium Sheet). Are with fees that are not linked to the bargain shutting successfully. Make costs per interaction somewhere in the, which is much less than what financial investment financial institutions gain even on "little bargains" (however the collection chance is likewise much higher).

The interview concerns are extremely similar to investment banking interview inquiries, but they'll focus much more on bookkeeping and evaluation and much less on subjects like LBO modeling. For instance, anticipate concerns regarding what the Modification in Capital means, EBIT vs. EBITDA vs. Web Revenue, and "accounting professional only" topics like test balances and how to stroll via events using debits and credit scores instead of financial declaration modifications.

Not known Facts About Transaction Advisory Services

that show exactly how both metrics have actually changed based on items, networks, and customers. to judge the precision of management's previous forecasts., consisting of aging, inventory by item, typical degrees, and provisions. to establish whether they're completely fictional or rather credible. Experts in the TS/ FDD groups may click to read also interview administration about whatever over, and they'll compose an in-depth record with their findings at the end useful content of the procedure.The power structure in Deal Providers differs a bit from the ones in financial investment financial and private equity jobs, and the basic shape appears like this: The entry-level role, where you do a whole lot of information and monetary analysis (2 years for a promotion from below). The following level up; comparable work, yet you obtain the more intriguing little bits (3 years for a promotion).

In particular, it's hard to obtain promoted past the Supervisor level since couple of people leave the work at that phase, and you need to start revealing proof of your ability to create earnings to advance. Let's start with the hours and way of living given that those are less complicated to describe:. There are occasional late evenings and weekend job, yet absolutely nothing like the agitated nature of financial investment financial.

There are cost-of-living adjustments, so anticipate reduced payment if you remain in a less costly place outside major economic facilities. For all settings except Partner, the base wage makes up the bulk of the complete payment; the year-end bonus may be a max of 30% of your base salary. Usually, the most weblink effective way to enhance your incomes is to switch to a various company and bargain for a higher salary and bonus

The Only Guide to Transaction Advisory Services

You might enter business development, however financial investment banking obtains harder at this phase because you'll be over-qualified for Expert roles. Business finance is still a choice. At this phase, you ought to simply remain and make a run for a Partner-level duty. If you intend to leave, perhaps relocate to a client and perform their appraisals and due diligence in-house.The main problem is that since: You normally require to sign up with an additional Huge 4 group, such as audit, and job there for a few years and after that relocate right into TS, work there for a few years and then move into IB. And there's still no warranty of winning this IB function because it depends on your region, customers, and the hiring market at the time.

Longer-term, there is additionally some risk of and because evaluating a company's historical monetary information is not specifically rocket scientific research. Yes, human beings will constantly need to be entailed, but with even more sophisticated innovation, reduced head counts could potentially support client engagements. That said, the Deal Providers team defeats audit in terms of pay, work, and departure opportunities.

If you liked this write-up, you may be interested in reading.

Transaction Advisory Services Fundamentals Explained

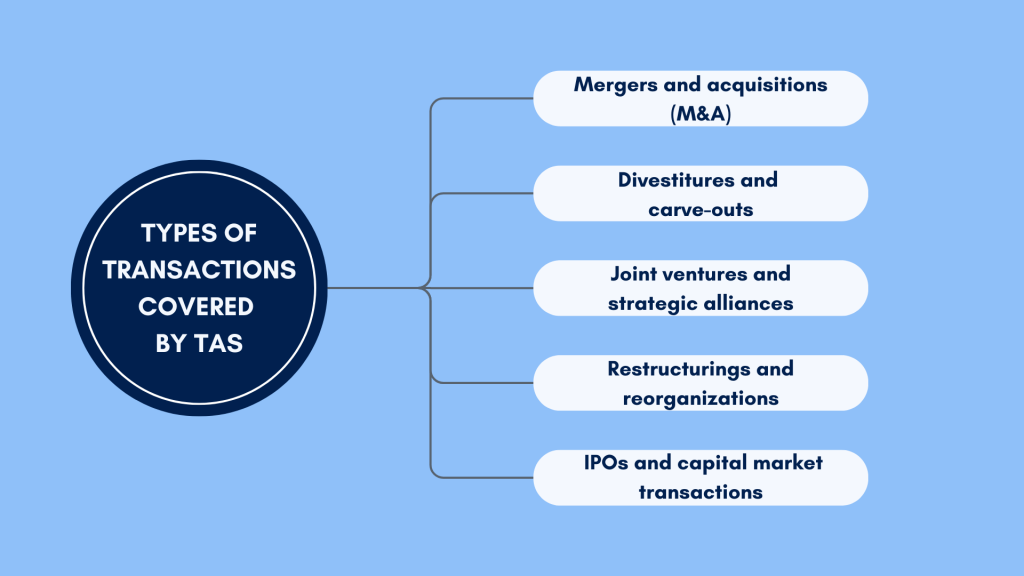

Develop innovative economic frameworks that aid in determining the real market worth of a company. Supply consultatory operate in connection to organization assessment to aid in bargaining and pricing frameworks. Describe the most suitable type of the deal and the sort of factor to consider to employ (cash, supply, earn out, and others).

Carry out combination preparation to establish the process, system, and business modifications that might be called for after the bargain. Establish guidelines for incorporating divisions, innovations, and service processes.

Analyze the prospective customer base, sector verticals, and sales cycle. The operational due diligence offers crucial understandings right into the performance of the firm to be acquired worrying risk analysis and worth development.

Report this wiki page